InPost Fresh: Zakupy w apce Aplikacje w Google Play

September 16, 2021Регистрация оффшоров открыть оффшорную фирму оффшор при помощи компании Incluence

November 18, 2021

When shares are kept with the intention of future resale, these shares are known as treasury stock. On the shareholders’ equity section of the balance sheet, the “Treasury Stock” line item refers to shares that were issued in the past but were later repurchased by the company in a share buyback. Journalize the above transactions according the par value method of accounting for treasury stock. The essential difference between dividends and treasury stock is that all shareholders receive cash when dividends are issued, but only stockholders who resell the stock to the corporation receive cash from treasury stock transactions. As this partial balance sheet shows, treasury stock is not shown as an asset but as a negative item in stockholders’ equity. The effect of the transaction is to reduce both assets and stockholders’ equity by $24,000.

- It then bought back 1,000 of the shares and paid a sum of $4,500 for the purchase.

- If the treasury stock is resold later, the cash account is increased through a debit while the treasury stock account is decreased.

- If the shares are priced correctly, the repurchase should not have a material impact on the share price – the actual share price impact comes down to how the market perceives the repurchase itself.

- If the total sales proceeds obtained from the resale of treasury stock exceed the original cash given to buy these shares back, the excess gain is taken to the additional paid-in capital account.

- Another reason for acquiring treasury stock exists for corporations whose shares are not traded on an active basis.

Q. Why do companies buy back their own stock?

In modern times, the par value assigned is a minimal amount, such as one penny. That avoids any potential legal liability if the stock drops below its par value. When a company or government issues a bond, its par value represents the amount of money the bond will be worth at its maturity date.

What is the difference between a par value and a no-par stock?

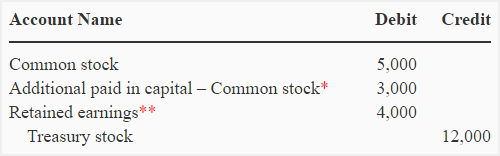

There are two methods possible to account for treasury stock—the cost method, which is discussed here, and the par value method, which is a more advanced accounting topic. The cost method is so named because the amount in the Treasury Stock account at any point in time represents the number of shares held in treasury times the original cost paid to acquire each treasury share. Under par value method, purchase of treasury stock is recorded by new able account advantages debiting treasury stock by the total par value of the shares. Cash account is credited for the actual amount paid to purchase the treasury stock. Any additional paid-in capital or discount on capital relating to treasury shares is cancelled by a debit or credit respectively. At this point, if the sum of credit side of the journal entry is less than the sum of debit side, additional paid-in capital account will be credited for the difference.

Par Value, Market Value, and Stockholder Equity

Due to double-entry bookkeeping, the offset of this journal entry is a debit to increase cash (or other asset) in the amount of the consideration received by the shareholders. Before jump to detail, let’s understand the overview as well as the key definition of treasury stock. In comparison, non-retired treasury stock is held by the company for the time being, with the optionality to be re-issued at a later date if deemed appropriate. One common reason behind a share repurchase is for existing shareholders to retain greater control of the company.

Which of these is most important for your financial advisor to have?

However, the more prevalent treatment in practice has been for all outstanding options – regardless of if they are in or out of the money – to be included in the calculation. Treasury Stock represents shares that were issued and traded in the open markets but are later reacquired by the company to decrease the number of shares in public circulation. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The market value of both bonds and stocks is determined by the buying and selling activity of investors in the open market. Most individual investors buy bonds because they represent a safe haven investment. The yield is paid in regular installments, providing income until the bond matures.

The following discussion focuses on the most straightforward types of transactions. Further, the equity accounts used are consistent with the simplified concept. That said, if a company has issued such securities in the past (i.e., the potential for conversion), its diluted EPS in all likelihood is going to be lower than its basic EPS.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. No-par stock does not have a stated or par value per share, while par value stocks do.

Book value will often be greater than par value, but lower than market value. Similarly, the value of the preferred stock is calculated by multiplying the number of preferred shares issued by the par value per share. Therefore, par value is more important to a company’s stockholders’ equity calculation.

In this post, we’ll cover the accounting treatment for various treasury stock transactions under both the par value method and the cost method, as well as the correct treatment when stock is donated or gifted back to a corporation. Each method and situation has unique journal entries that reflect the correct way to record these equity transactions. Even though the company is purchasing stock, there is no asset recognized for the purchase. Immediately after the purchase, the equity section of the balance sheet (Figure 5.62) will show the total cost of the treasury shares as a deduction from total stockholders’ equity. By multiplying the fully diluted shares outstanding by the current share price, we calculate that the net impact of dilutive securities is $2mm and the diluted equity value is $202mm. The common stock APIC account is also debited to decrease it by the amount originally paid over the par value by the shareholders.

This method assumes that the proceeds a company receives from an in-the-money option exercise are used towards repurchasing common shares in the market. Assume Duratech’s net income for the first year was $3,100,000, and that the company has 12,500 shares of common stock issued. During May, the company’s board of directors authorizes the repurchase of 800 shares of the company’s own common stock as treasury stock.

Many corporations also acquire treasury shares as a way of investing in corporate funds. The stock market will determine the real value of a stock, and it continually shifts as shares are bought and sold throughout the trading day. When shares of stocks and bonds were printed on paper, their par values were printed on the faces of the shares.